Only Benefeature combines retirement and group benefits data in one platform.

Powered by 24 years of proprietary AskGMS data no other platform has.

.png)

Join the carriers and brokers who finally see retirement and group benefits together

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Most employers have both retirement and group benefits, but the data is siloed in separate systems.

That makes it impossible to see the complete picture of an employer's total benefits spend and strategy.

With Benefeature, that's changed.

.png)

Retirement and group benefits data exists in separate, unconnected systems.

Can't see total benefits spend or understand the complete strategy.

Harder to identify cross-selling opportunities and strategic insights.

Difficult to make informed decisions without integrated data.

Benefeature doesn't guess. We integrate retirement and group benefits data using 24 years of proprietary data from AskGMS.

That means your team can see the complete picture of an employer's benefits strategy, identify opportunities, and make better decisions.

Go beyond siloed data to understand total benefits spend and strategic alignment.

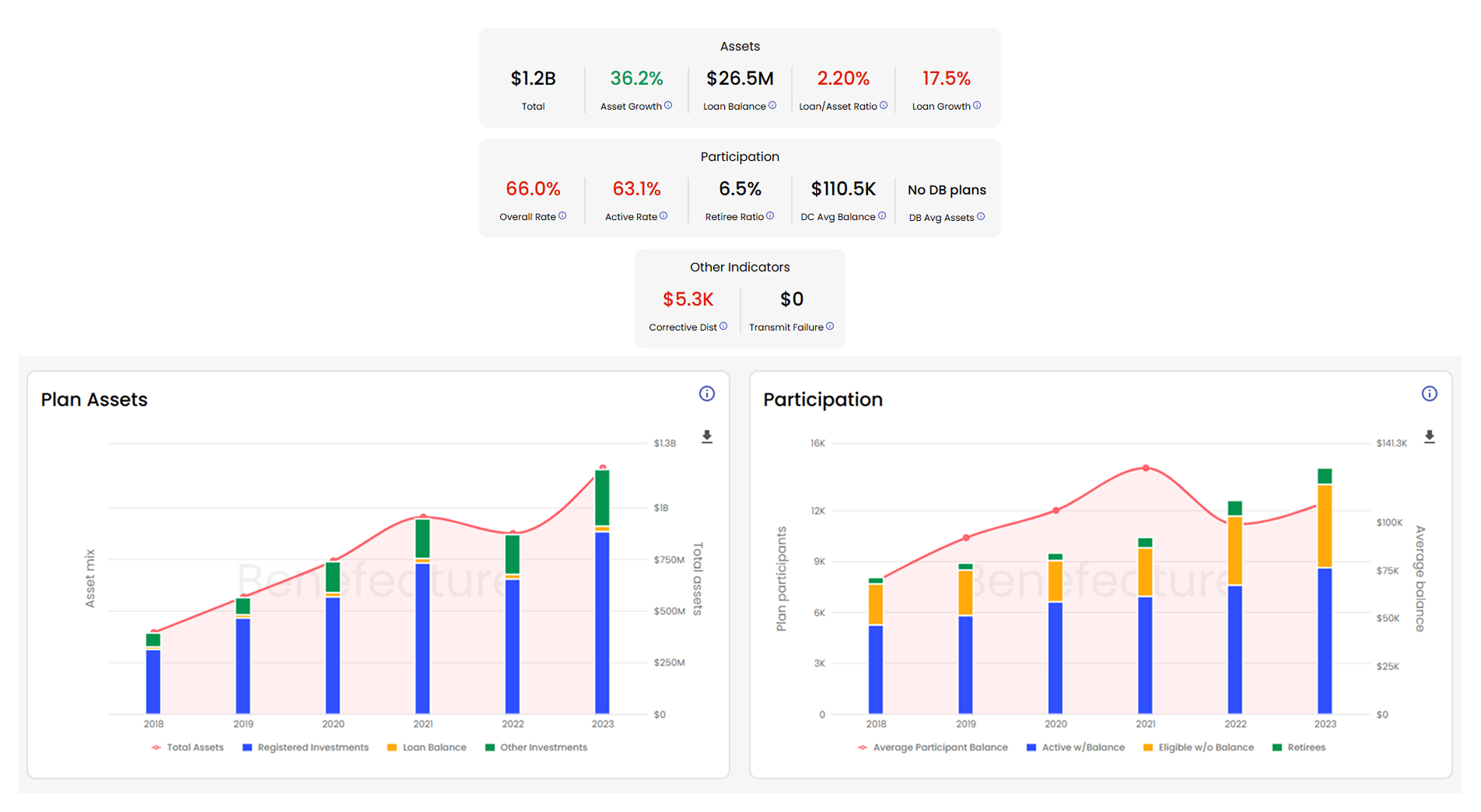

See retirement and group benefits data together in one platform

Understand complete benefits strategy and total spend

Identify opportunities across retirement and group benefits

Make informed decisions with complete data visibility

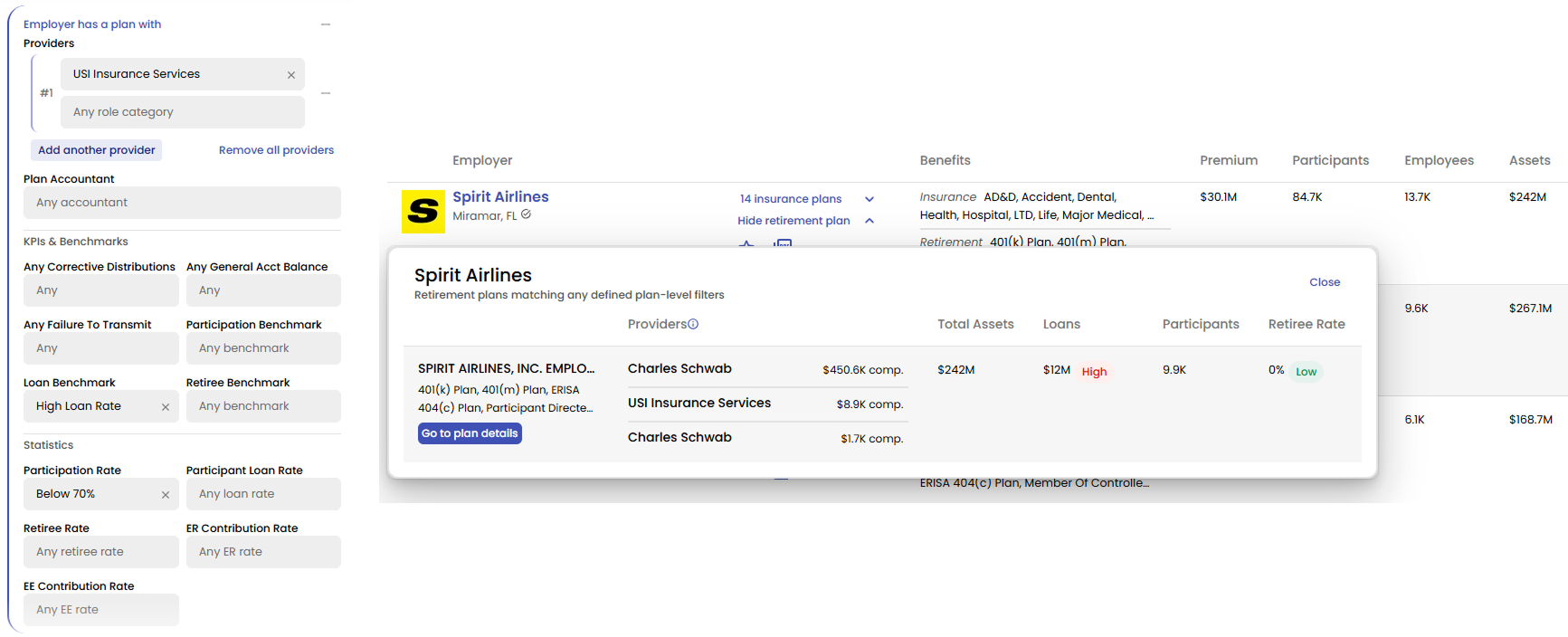

Identify common customers across both retirement and group benefits to spot warm leads and cross-selling opportunities.

Spot coverage gaps by identifying employers with high loan rates in their 401(k) plans, indicating potential need for additional benefits.

Find common customers across retirement and group benefits for targeted outreach

Identify employers with high 401(k) loan rates indicating coverage gaps

Leverage existing relationships to expand into new benefit categories

Identify employers with financial stress indicators for targeted benefit solutions

Benefeature has unlocked new capabilities for our Group Insurance business. For starters, Benefeature data has helped us confirm and challenge anecdotal local market feedback from our sales team.

Join the carriers who finally see retirement and group benefits together.